Introduction

Buy Now, Pay Later (BNPL) has transformed from alternative payment method to mainstream consumer expectation, with the BNPL market reaching $160 billion globally in 2024 and projected to hit $580 billion by 2028 (Research and Markets, 2024). More critically for e-commerce retailers, 55% of consumers have used BNPL services, with 76% of Gen Z and Millennials preferring stores offering installment payments (Lending Tree, 2024).

The business impact justifies integration: stores offering BNPL report 20-30% higher average order values, 10-15% conversion rate improvements, and 35-50% increase in repeat purchase rates compared to credit card-only checkouts (Affirm Merchant Data, 2024). The payment flexibility removes purchase barriers, particularly for higher-ticket items ($200+), while BNPL providers assume credit risk, ensuring merchants receive full payment upfront.

This guide explores how to integrate BNPL strategically - selecting appropriate providers, implementing effectively, and maximizing revenue impact while understanding costs and risks.

Understanding Buy Now, Pay Later Models

BNPL services allow customers splitting purchases into interest-free installments while merchants receive full payment immediately, creating win-win dynamics.

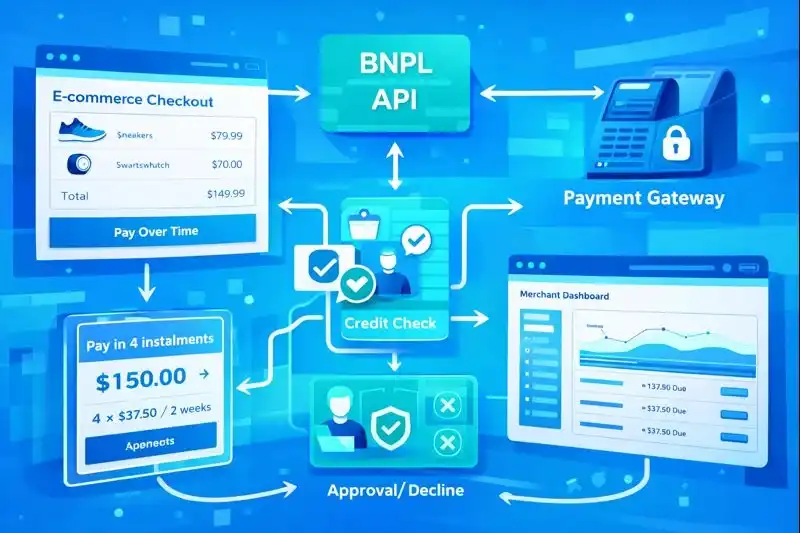

How BNPL Works

Customer perspective: Select BNPL at checkout alongside credit card/PayPal options. Instant approval (soft credit check, no impact on credit score for most providers). Split payment into 4 equal installments (most common) or 3-36 month plans (for higher amounts). First payment due at purchase or 2-4 weeks later depending on provider. Remaining payments auto-deducted every 2 weeks or monthly.

Merchant perspective: Customer completes purchase using BNPL. Full payment received from BNPL provider within 2-7 days (minus merchant fee). BNPL provider assumes credit risk - merchant paid regardless of customer payment behavior. Returns processed through standard process, BNPL provider handles refunds.

BNPL vs. Credit Cards

BNPL advantages: No interest for customers (when paid on time), easier approval (less stringent than credit cards), transparent costs (fixed installments vs. revolving debt), appeals to debt-averse consumers avoiding credit cards.

Credit card advantages: Rewards programs, fraud protection, universal acceptance, longer dispute windows.

Why consumers choose BNPL: 45% use BNPL to avoid credit card interest, 38% for better budgeting (fixed payments), 31% couldn't afford upfront (PYMNTS, 2024).

Major BNPL Providers

Afterpay (owned by Block/Square) - 6-week payment plans (4 installments), instant approval, no interest ever, $50-$2,000 limits typically. Strong with Gen Z/Millennials, fashion/beauty focus.

Klarna - Pay in 4 or monthly financing (6-36 months), "Pay in 30 days" single payment option, gamified app experience, broader merchant base (100,000+ retailers).

Affirm - Focus on higher-ticket items ($100-$17,500), transparent interest (0-36% APR depending on creditworthiness), 3-48 month terms, strong in furniture, electronics, travel.

PayPal Pay in 4 / PayPal Credit - Leverages existing PayPal user base, pay in 4 interest-free, longer-term financing options, easy integration for PayPal merchants.

Apple Pay Later - iPhone-only, pay in 4 over 6 weeks, Apple Wallet integration, no merchant fees (Apple subsidizes), limited availability (US only currently).

Integrating BNPL into Your E-commerce Store

Implementation varies by platform and provider but follows common patterns for seamless checkout integration.

Platform-Specific Integration

Shopify: Native apps for all major BNPL providers (Afterpay, Klarna, Affirm, PayPal). Install app, create provider account, activate in checkout settings. Setup time: 30-60 minutes. Shopify Payments includes Shop Pay Installments (built-in BNPL, no third-party needed).

WooCommerce: Official plugins available for Afterpay, Klarna, Affirm. Install plugin, configure API credentials, enable payment method. Slightly more technical than Shopify but well-documented.

BigCommerce: App marketplace integrations for major providers. Similar ease to Shopify.

Custom platforms: Direct API integration required - more complex but fully customizable. Development time: 2-8 weeks depending on complexity.

Checkout Placement Best Practices

Payment method section: Display BNPL alongside credit card, PayPal as equal option. Messaging: "Or pay in 4 interest-free installments" with provider logo.

Product page messaging: "As low as $25/month with Affirm" on product pages for items $100+. Increases conversion 8-12% by surfacing payment flexibility before checkout.

Cart page: Reminder of BNPL availability - "Break this $250 purchase into 4 payments of $62.50."

Above the fold: For higher-ticket items (furniture, electronics), prominent BNPL messaging in hero sections - "Finance available from $29/month."

Mobile optimization: BNPL adoption 60-70% mobile-driven - ensure mobile checkout displays BNPL clearly, tap-friendly buttons.

Provider Selection Strategy

Don't offer every BNPL option - confuses customers and fragments usage. 2-3 providers maximum: Afterpay OR Klarna for 4-payment model (choose based on fees + demographics). Affirm OR PayPal Credit for longer-term financing (higher tickets). Apple Pay Later if significant iPhone user base (zero merchant fees make it no-brainer).

Selection criteria: Merchant fees (2-8% depending on provider and risk), customer demographics (Afterpay Gen Z-focused, Affirm broader), approval rates (Klarna highest at ~85%, Affirm more selective), integration ease (PayPal fastest if already integrated), brand reputation (consumers recognize/trust provider).

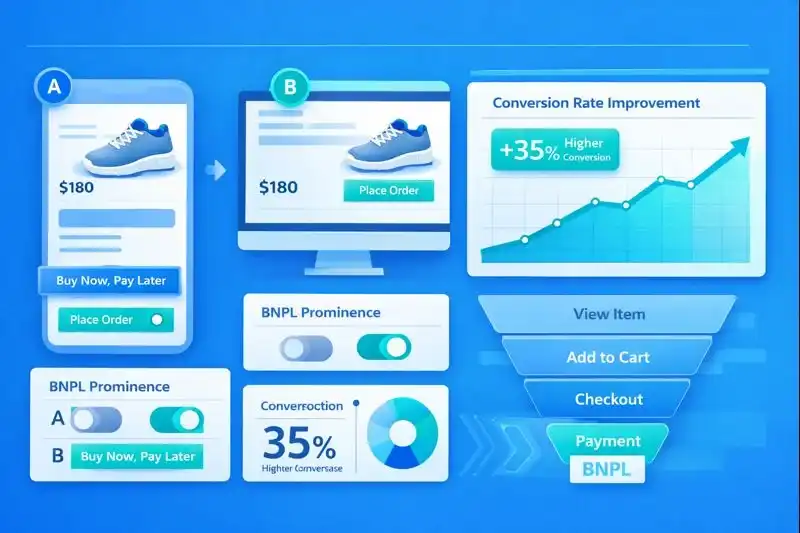

Testing period: A/B test providers for 30-60 days, measure adoption rate, AOV, conversion impact. Stick with highest performing options.

Maximizing BNPL Revenue Impact

Strategic implementation beyond basic integration unlocks full BNPL potential for conversion and order value improvement.

Promotional Campaigns

BNPL-focused promotions: "4 interest-free payments when you spend $150+" drives order size to BNPL minimum. Email campaigns to existing customers announcing BNPL availability - "Now offering Afterpay!" drives 5-10% repeat purchase lift.

Holiday amplification: Promote BNPL heavily during Q4 - "Shop now, spread holiday costs over 6 weeks." 45% of BNPL usage occurs Nov-Dec.

Social media: Highlight payment flexibility in ads - "Own it now for $50 today, pay rest later" performs 25-30% better CTR than standard product ads for $200+ items.

Dynamic Messaging

Cart threshold prompts: "Add $50 more for Afterpay eligibility" when cart at $45 (if $50 minimum exists). Increases AOV 15-20%.

Product page calculations: Real-time installment amounts - "$125 or 4 payments of $31.25 with Klarna." Makes high prices feel accessible.

Checkout abandonment: Retarget cart abandoners with BNPL messaging - "Complete your $200 purchase for just $50 today!" Recovers 8-12% of abandonments.

Category-Specific Strategy

High-ticket items ($300+): Emphasize monthly payments - "$899 laptop for $75/month" vs. "$899." Affirm with 12-month terms appropriate.

Mid-range ($100-$300): Pay in 4 messaging - break into digestible chunks without long-term commitment. Afterpay/Klarna ideal.

Low-ticket (under $50): Don't promote BNPL heavily - fees eat into margins, customers don't need financing. Focus BNPL on $100+ baskets.

Customer Education

FAQ section: Common questions - "How does BNPL work?", "Is there interest?", "What if I return item?" Reduces friction - many consumers unfamiliar with BNPL mechanics.

Trust signals: Provider logos prominently displayed, "No impact on credit score" messaging, "Trusted by 10M shoppers" social proof.

Post-purchase communication: Email confirming BNPL setup, payment schedule reminders, links to manage payments in provider apps.

Returns and Customer Service

Clear return policies: BNPL + returns can confuse customers. "Refunds processed to your BNPL account within 5-7 days, installment plan cancelled automatically."

Customer service training: Support team educated on BNPL processes, provider contact info, troubleshooting payment issues.

Understanding BNPL Costs and Economics

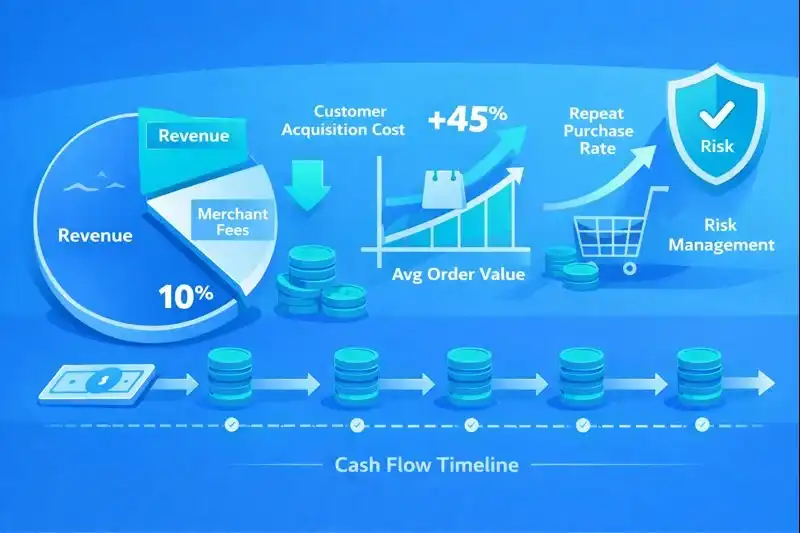

BNPL merchant fees are higher than credit cards but can deliver positive ROI through conversion and AOV improvements.

Merchant Fee Structure

Afterpay: 4-6% of transaction value, varies by merchant size/industry. Klarna: 3.29% + $0.30 per transaction (Pay in 4) to 5.99% + $0.30 (financing). Affirm: 2.9% + $0.30 (low risk) to 10-15% (higher risk/longer terms). PayPal Pay in 4: ~3.49% + $0.49. Apple Pay Later: $0 (Apple subsidizes entirely).

Comparison: Credit cards charge 2.9% + $0.30 typically. BNPL 1-8% premium vs. cards.

ROI Calculation

Scenario: $200 average order, 3% baseline conversion, 2.9% card processing fee.

Without BNPL: 1,000 visitors × 3% conversion × $200 AOV = $6,000 revenue - $174 fees (2.9%) = $5,826 profit (before COGS).

With BNPL: 10% higher conversion (3.3%), 25% higher AOV ($250). 1,000 visitors × 3.3% × $250 = $8,250 revenue - 40% use BNPL at 5% fee ($3,300 × 5% = $165) - 60% use cards ($4,950 × 2.9% = $144) = $7,941 profit.

Net improvement: $7,941 - $5,826 = $2,115 profit gain (+36%) despite higher BNPL fees.

Break-Even Analysis

BNPL profitable when: (Conversion improvement % × AOV improvement %) > (BNPL fee - card fee).

Example: 5% BNPL fee - 3% card fee = 2% fee premium. Requires 2%+ revenue improvement to break even. Most merchants achieve 15-30% revenue lift easily exceeding fee costs.

Risk Considerations

Merchant risk: Zero credit risk - BNPL provider pays upfront regardless of customer payment. Return risk - if customer defaults and returns, merchant still paid (BNPL provider absorbs).

Chargebacks: Handled by BNPL providers in most cases. Merchant protected from fraudulent transactions.

Customer limits: BNPL providers set per-customer spending limits ($50-$2,000 typical). May reduce very large purchases vs. credit cards allowing higher limits.

Frequently Asked Questions

What products work best with BNPL financing?

BNPL performs best for discretionary purchases $100-$2,000 where payment flexibility drives conversion. Top categories: Fashion and apparel (40% of BNPL usage) - customers buy multiple items or splurge on premium brands. Electronics (22%) - $200-$1,500 gadgets, laptops, phones feel accessible at $50-$125/month. Home and furniture (18%) - $300-$3,000 purchases split into manageable payments. Beauty and cosmetics (12%) - premium skincare sets, makeup bundles. Underperforming categories: Groceries and essentials (customers need immediate affordability, not financing), ultra-low-ticket (< $50 purchases don't need payment plans), services (subscriptions work better as recurring payments vs. BNPL). Sweet spot: $150-$800 products - high enough that financing valuable, low enough for 4-payment plans. Above $800: longer-term financing (Affirm 6-36 months) better than pay-in-4 models. Product characteristics: Discretionary (want vs. need), visible quality (customers willing to stretch budget for better items), gift-worthy (holidays drive BNPL usage).

How much do BNPL services cost merchants?

Merchant fees range 2.9-15% depending on provider, plan length, and risk profile. Pay in 4 models (Afterpay, Klarna, PayPal): 3.29-6% of transaction. No monthly fees, charged per transaction only. Longer-term financing (Affirm, Klarna Financing): 2.9-15% - higher percentages for longer terms (12-36 months) and riskier merchant categories. Apple Pay Later: $0 merchant fee (Apple subsidizes to drive Apple Pay adoption). Volume discounts: Larger merchants (> $1M BNPL volume annually) negotiate lower rates (1-2% reduction possible). Comparison: Credit cards: 2.9% + $0.30, BNPL premium: 0.4-12% above cards depending on model. Hidden costs: Integration (minimal with Shopify apps, $2,000-$10,000 for custom platforms), customer service (handling BNPL-related inquiries), marketing (promoting BNPL availability). Return processing - if high return rates, BNPL fees on returned items eat into margins (though customer refunds handled by provider). Total cost typically 3-8% of BNPL transaction volume for most merchants.

Does offering BNPL actually increase sales?

Yes - data consistently shows 10-30% conversion improvements and 20-30% higher AOV. Conversion impact: Stores adding BNPL see 10-15% overall conversion increase, 25-35% improvement for $200+ products specifically. Customers who view BNPL messaging convert 20% higher than those who don't (Afterpay, 2024). Average order value: BNPL users spend 20-30% more than credit card users. "Pay in 4" psychological effect - $200 feels like $50 making customers comfortable buying more. Repeat purchase: BNPL customers return 35-50% more frequently - positive experience + payment flexibility drives loyalty. Cart abandonment recovery: BNPL messaging recovers 8-12% of abandonments targeting price-sensitive shoppers. Demographic expansion: BNPL attracts younger customers (Gen Z, Millennials) who avoid credit cards, expanding customer base. Seasonal impact: Q4 (holidays) sees 3-5x BNPL transaction volume - payment flexibility enables more gift purchases. Category variation: Electronics see 35% BNPL lift, fashion 25%, groceries minimal (< 5%). Caution: Results require proper implementation - product page messaging, checkout optimization, promotional campaigns. Just adding BNPL without promotion yields 5-8% vs. 15-30% with strategic rollout.

Are there risks to offering BNPL as a merchant?

Minimal financial risk for merchants, but operational and strategic considerations exist. Financial risk: Nearly zero - BNPL providers assume credit risk. Merchant receives full payment upfront regardless of customer repayment. Only risk: return/refund processing but standard policies apply. Operational challenges: Customer service complexity - inquiries about BNPL payments, managing returns with installment plans, troubleshooting provider integration issues. Requires staff training. Returns and refunds - if customer defaults on BNPL then returns item, merchant still refunds BNPL provider (not directly exposed to customer). However, high return rates + BNPL fees squeeze margins. Strategic risks: Margin pressure - 3-8% BNPL fees reduce profit per transaction vs. credit cards (2.9%). Must ensure conversion/AOV gains exceed fee costs. Brand positioning - some luxury brands avoid BNPL fearing cheapening perception. Consider brand image. Customer dependency - over-reliance on BNPL may create price-sensitive customer base expecting financing always available. Regulatory uncertainty - BNPL facing increasing regulation (UK treating as credit, potential US regulations). Future fee structures, requirements may change. Mitigation: Calculate ROI before launch - test with sample, measure impact. Strategic BNPL use - don't position as desperate for sales, frame as customer convenience. Monitor metrics - if BNPL users have higher return rates or lower LTV, reconsider. For most merchants, benefits far outweigh risks when implemented thoughtfully.

Should I offer multiple BNPL providers or just one?

Offering 2-3 providers maximizes coverage but more causes diminishing returns and confusion. Single provider pros: Simplicity - easier for customers, cleaner checkout, higher volume per provider (may negotiate better rates), lower operational complexity. Cons: Limited approval - each provider has different credit criteria. One provider rejects 15-30% of applicants who might approve elsewhere. Multi-provider pros: Higher approval rates - offering Afterpay + Affirm captures 90%+ of BNPL-ready customers vs. 70-85% with one. Demographic coverage - Afterpay for Gen Z, Affirm for Millennials, PayPal for older shoppers. Flexible terms - short-term (Afterpay) + long-term (Affirm) meets different needs. Cons: Customer confusion - "Which do I choose?" overwhelms. Split volume reduces negotiating power. Increased integration cost/complexity. Recommended approach: Primary provider (highest approval rate, best brand fit) + secondary provider (different strength - short vs. long-term, different demographic). Example combinations: Klarna + Affirm (short-term + long-term), Afterpay + PayPal Credit (Gen Z + existing PayPal users), Apple Pay Later + Affirm (free iOS option + Android/long-term). Avoid: 3+ providers in checkout - diminishing returns, confusing. Platform limitations: Some platforms (Shopify) make multi-provider easy, others (custom builds) require significant development. Test strategy: Launch with one provider, measure approval/usage rates after 60 days, add second if 20%+ applicants rejected.

Related Articles

- Subscription Commerce Models: Building Recurring Revenue - Combine BNPL with subscription models for accessible recurring revenue

- How to Keep Customers After the Promotion Ends - Convert BNPL first-time buyers into loyal repeat customers

- Voice Commerce & Smart Assistants Guide - Enable voice-activated BNPL purchases through smart speakers

Conclusion

Buy Now, Pay Later has evolved from payment novelty to consumer expectation, with $160 billion in global transactions in 2024 and 76% of Gen Z/Millennials preferring stores offering installments. The business case is compelling: 20-30% higher AOV, 10-15% conversion improvements, and 35-50% repeat purchase increases typically offset 3-8% merchant fees through substantial revenue gains.

Strategic BNPL implementation requires thoughtful provider selection (2-3 maximum - balance approval rates with simplicity), prominent messaging (product pages, cart, checkout displaying installment amounts), category focus ($100-$2,000 sweet spot where financing drives conversion), and promotional amplification (holiday campaigns, email announcements, social media ads highlighting flexibility).

Start with single provider matching your demographics (Afterpay for Gen Z fashion, Affirm for electronics/furniture, PayPal for existing user base), measure impact for 60-90 days (conversion rate, AOV, repeat purchase), calculate ROI ensuring revenue lift exceeds fees, then optimize messaging and consider second provider if approval gaps exist. For most e-commerce businesses selling $100+ discretionary products, BNPL delivers measurable results justifying integration complexity and fees.